Trading With Exness Legally Compliant: A Comprehensive Guide

In today’s fast-paced financial environment, Trading With Exness Legally Compliant trading with Exness legally compliant operations has become more crucial than ever for investors and traders. Ensuring that your trading practices align with regulatory standards not only safeguards your investments but also enhances your credibility in the trading community. This article explores the importance of legal compliance in trading, what makes Exness a suitable broker for compliant trading, and the steps you can take to ensure that your trading activities are in accordance with legal requirements.

The Importance of Legal Compliance in Trading

Legal compliance in trading refers to adhering to the laws and regulations established by regulatory bodies in the financial markets. This is imperative for several reasons:

- Protection Against Fraud: Complying with legal standards helps protect traders from potentially fraudulent activities. Legitimate brokers are regulated and must adhere to strict guidelines, which can prevent many forms of misconduct.

- Legal Security: Engaging in trading with a compliant broker like Exness ensures that your funds are protected under relevant financial regulations, providing a safety net in case of disputes.

- Market Integrity: Legal compliance contributes to the overall integrity of the financial markets. When traders and brokers adhere to laws, it fosters trust among participants and promotes fairness.

Exness: A Regulated and Compliant Broker

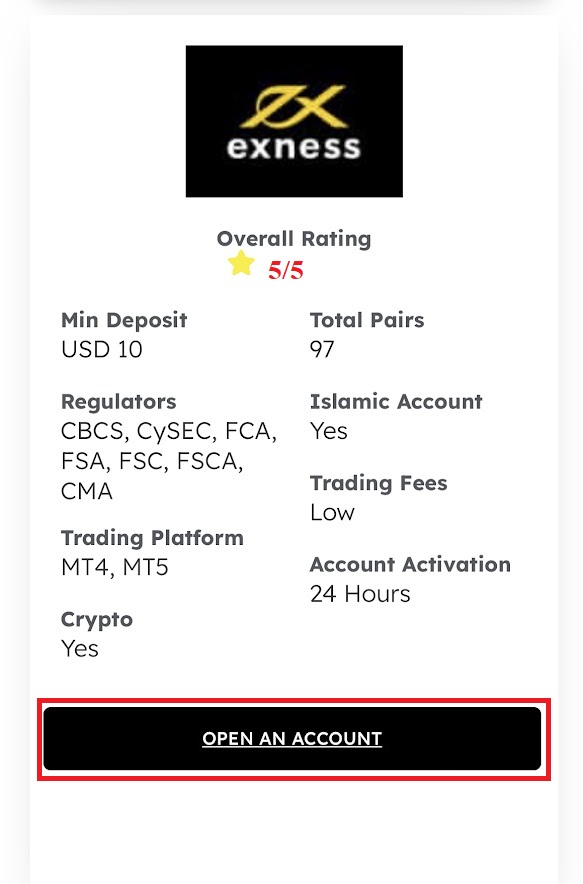

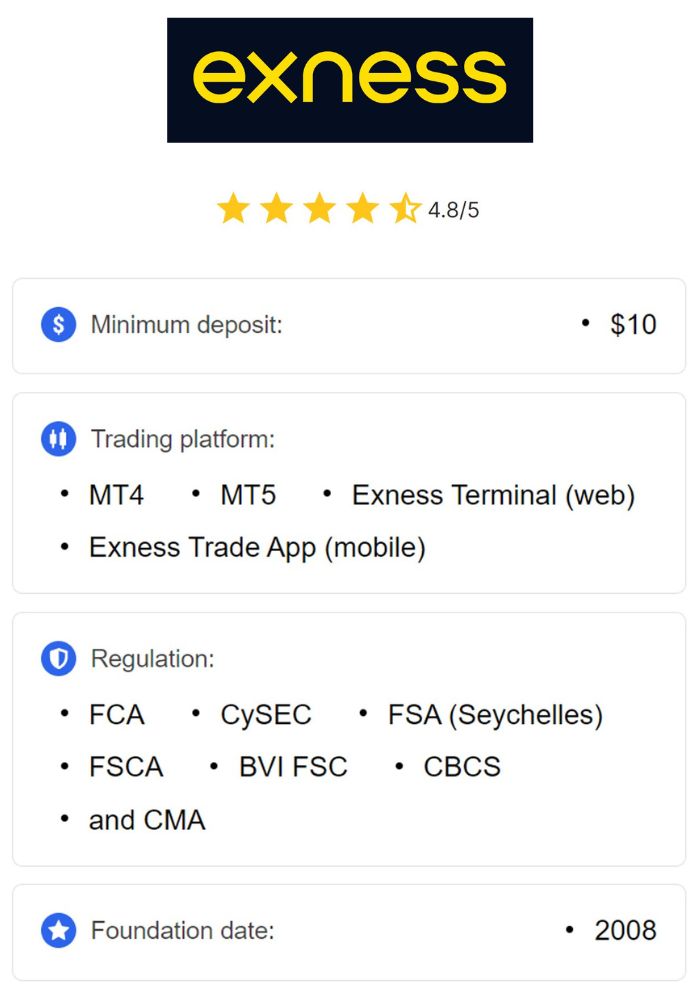

Exness is recognized as one of the leading brokerage firms in the industry, with a strong reputation for legal compliance. Here are some key aspects that outline Exness’s commitment to being a compliant trading platform:

- Regulation by Recognized Authorities: Exness holds licenses from several reputable regulatory bodies, including the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). These licenses signify that Exness adheres to stringent regulatory requirements.

- Transparent Operations: A legally compliant broker openly shares information about its operations, fees, and trading conditions. Exness provides clear guidelines and terms to ensure that traders understand the nature of their trades.

- Protection of Client Funds: Exness ensures that client funds are kept in segregated accounts. This means that your funds are separate from the broker’s operational funds, providing an extra layer of security.

Steps to Ensure Legally Compliant Trading

To trade legally and responsibly, follow these guidelines:

1. Choose a Regulated Broker

When selecting a broker, verify its regulation status. Trading with a regulated broker like Exness ensures that you are operating within the bounds of the law.

2. Understand the Local Laws

Different countries have varying regulations regarding trading and investments. Familiarize yourself with your country’s trading laws to ensure that your activities are compliant.

3. Keep Accurate Records

Maintain thorough records of your trading activities, including transactions, communications with your broker, and documents related to your financial activities. This can be crucial if you ever require proof of your compliance.

4. Stay Updated on Regulatory Changes

Financial regulations can change. Staying updated on new laws or amendments will help you remain compliant and avoid potential issues in the future.

Common Compliance Issues in Trading

Even with the best intentions, traders can sometimes inadvertently breach compliance regulations. Here are a few common issues:

- Trading with Unregulated Brokers: Engaging with unregulated brokers exposes traders to risks, including fraud and lack of protection for funds.

- Failure to Report Income: It is important for traders to report their trading income accurately to tax authorities to avoid legal penalties.

- Insider Trading: Engaging in illegal trading based on non-public information is a serious compliance violation that can lead to severe penalties.

Conclusion

Trading with Exness legally compliant practices is not just about avoiding penalties; it’s about building a sustainable and trustworthy trading experience. By choosing a regulated broker, understanding local laws, keeping thorough records, and staying informed on regulatory changes, you can ensure that your trading activities comply with all legal requirements. Ultimately, investing in your compliance will lead to a safer, more profitable trading journey.

As you embark on your trading journey, remember that compliance and integrity should always go hand-in-hand. By adhering to the principles outlined in this article, you can position yourself not only as a trader but also as a responsible member of the financial community.